THE SECONDARY MARKET

In addition to the London head office, Anglo-Suisse Capital also has representatives in Zurich and Monaco. The senior partners of Anglo-Suisse Capital have advised on transactions totalling almost $30 billion in value.

PRIVATE PLACEMENTS

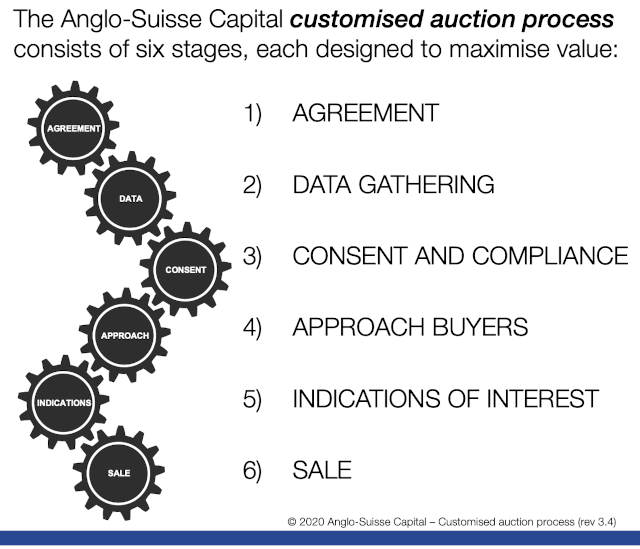

Anglo-Suisse Capital uses a customised auction process, refined over the last 10 years, to facilitate sales of illiquid share stakes in unquoted companies for institutional shareholders.

MAXIMISING THE REALISED VALUE

- Maximises proceeds from illiquid positions valued $10 million plus

- Well-established formula developed over 8 years

- Targeted broad market coverage

- Different types of buyers to eke out a premium

- Quick process

- Utmost discretion, tailored to your requirements

TRACK RECORD

Anglo-Suisse Capital is a London based international investment banking firm. The senior members of the team have advised on almost $30 billion of transactions, including over $6 billion of secondary trades of alternatives, including private equity funds, hedge funds and direct private investments. Of these, selling a stake in Facebook when it was still a private company is probably the most high profile.

Anglo-Suisse Capital knows a number of buyers suitable for unicorn and late stage stakes, by type:

- buyers which specialise in secondaries of late stage private companies (series C onwards) who have informed us of their preferred investment criteria and ticket sizes

- significant number of generalist buyers (e.g. family offices) who like the sector

- many strategic buyers and their search criteria (thereby increasing the scope for a premium price)

QUICK. DISCREET. PROFESSIONAL.